AI to ROI

Where AI News Meets Business Impact

AI Story of the Week

The $1M ARR per Employee Era: How AI-Native Startups Are Rewriting the Rules of Scale

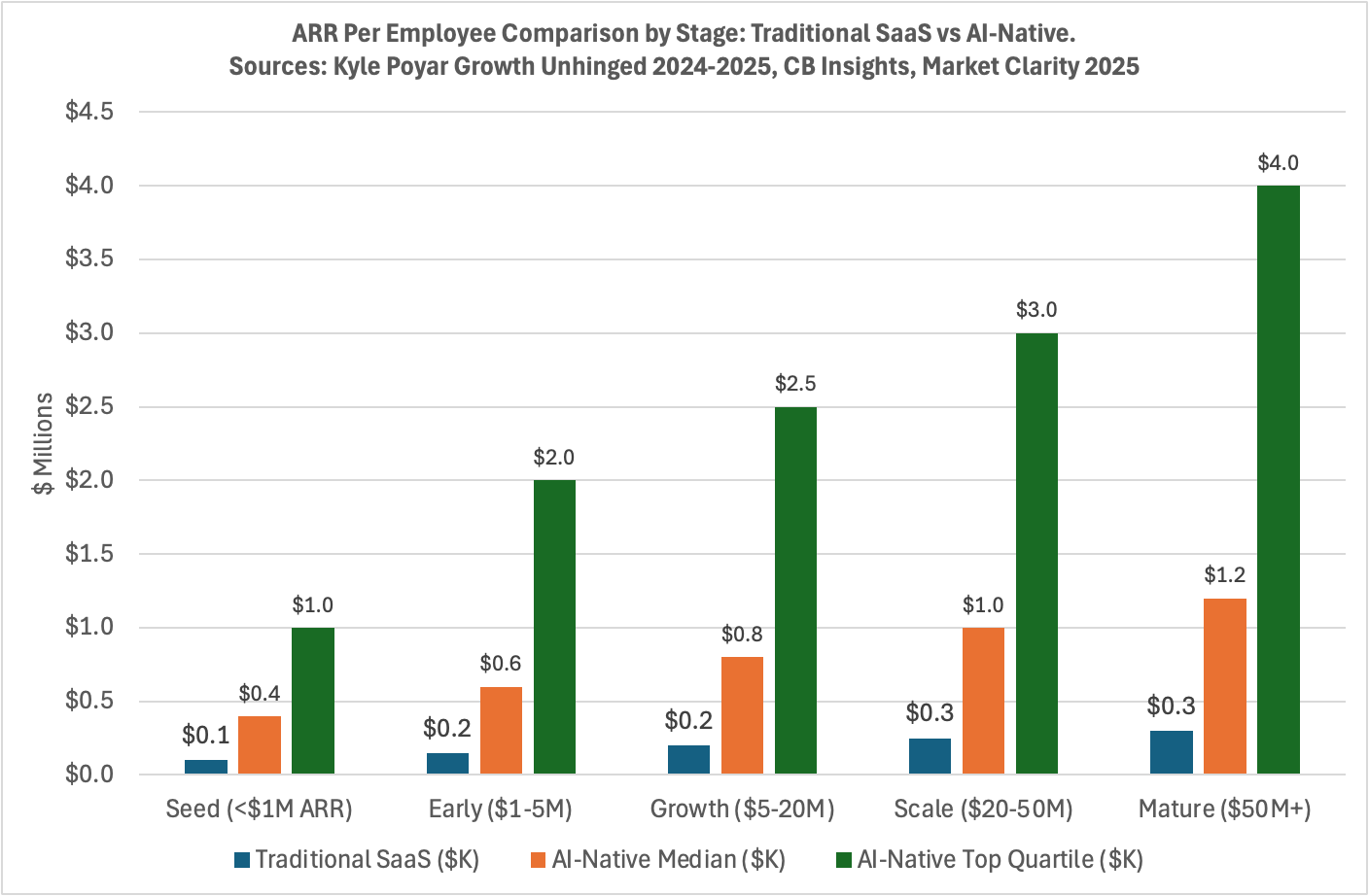

Back in 2021, a successful startup SaaS company would typically generate about $250,000 in ARR per employee as they scale above $50M ARR and employ about 200 people. Fast forward to 2026, and the economics of software companies are changing. Over 50 AI-native companies are expected to hit $10 million in ARR with fewer than 10 employees this year, a feat that would have been impossible five years ago.

This isn’t an incremental improvement; it’s a productivity revolution. Here are some famous examples:

Midjourney surpassed $200 million in ARR with a core team of only 11 people. They achieved this through a product-led growth strategy centered on a Discord-based interface, bypassing the need for a traditional sales or marketing department.

Magnific AI is an AI image upscaler and enhancer that reached an estimated $10M ARR with a team of just 2 people. Their success was driven by extreme viral growth on social media platforms like X. The company was eventually acquired by Canva in early 2024.

Zaz OS is a vertical AI player targeting the enterprise internal tooling market. Zaz OS hit the $10 million in ARR milestone with 8 employees in late 2025. Their mission is to enable non-IT staff (HR, Logistics, Operations) to build and maintain their own internal business operating systems using natural language.

Aragon.ai specializes in AI-generated professional headshots. It reached the $10 million in ARR milestone with a team of 9 employees. They solved a specific, high-friction problem, the cost and time of professional photography, allowing for rapid, automated scaling.

Anything goes beyond simple code generation to provide complete infrastructure (databases, payments, and App Store deployment). It reached $2M ARR in its first two weeks, quickly scaling past the $10M ARR mark by late 2025 with a team of 5–7 employees. Anything focuses on helping non-technical founders launch production-ready software rather than just prototypes.

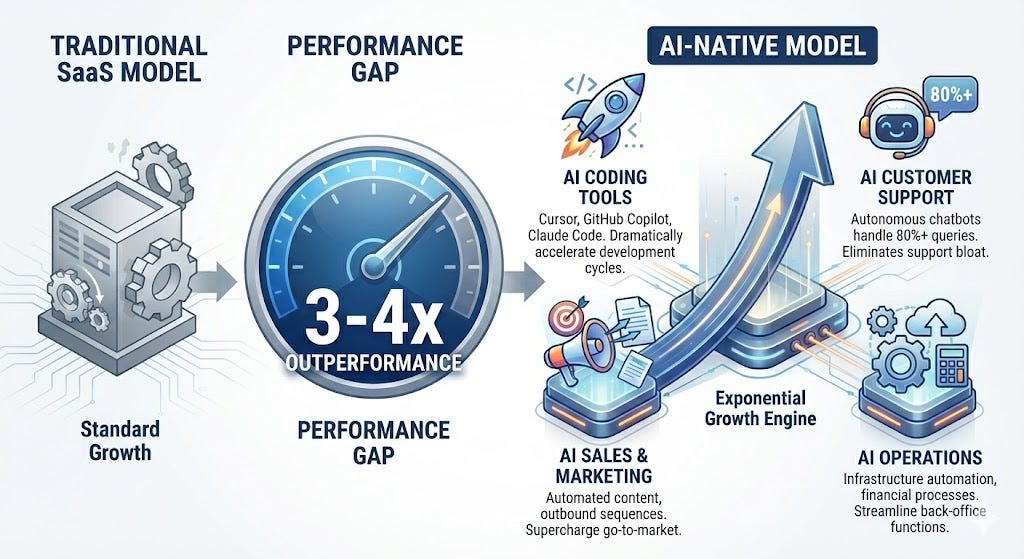

These AI-native companies, as measured by revenue productivity are outperforming SaaS companies by 3-4x, driven by four key factors:

AI coding tools dramatically accelerate development

AI customer support eliminates support bloat

AI sales and marketing supercharge go-to-market

AI operations streamline back-office functions

A focus on product-led growth using AI tools

Viral marketing programs that leverage users. communities and influencers

The DNA of AI-Native $1M ARR Per Employee Companies

AI-native companies share characteristics that set them apart including:

API-first with minimal human intervention

Use consumption-based pricing aligned with customer value

Aggressively deploy AI throughout their stack

Cultivate an “AI-first” culture from day one

Consider this example:

A vertical AI applications company builds an entire product with 2 engineers using AI coding tools

Deploys an AI customer success system handling 500+ customers

Runs marketing through AI content generation and programmatic SEO

Achieves $12 million in ARR with just 7 full-time employees

Critical Hires and Key Skills

The talent playbook for an AI-native company is fundamentally different. Instead of building large, specialized teams, AI-native companies hire technical generalists who can leverage AI to multiply their impact. As Bessemer Venture Partners’ research on AI supernovas reveals, companies like Cursor hire salespeople who also write code and use AI to automate their own workflows.

Essential roles include:

Technical founders who can build and sell

AI-native engineers are comfortable with rapid prototyping

Product-led growth specialists who understand viral mechanics

Technical go-to-market teams that automate rather than scale headcount

Forward-deployed engineers who ensure implementations are successful, while collecting customer requirements that are quickly introduced into the product

At Anthropic, the sales team operates without traditional quotas. Kelly Loftus, who leads startup sales, explained:

“We couldn’t predict adoption, so instead of quotas, we built around feedback and mission. We call them ‘shadow targets.”

Automation as Core Architecture + An AI-Native Tech Stack

These companies don’t just use automation; they’re built on it. Every function that can be automated is automated from day one. According to research from a16z:

AI-native companies achieve 132% net revenue retention compared to 108% for traditional SaaS companies, while operating with 7-8x fewer employees per dollar of revenue.

AI-native products share some common technical characteristics:

Cloud-based infrastructure that scales automatically

API-first products requiring minimal human touch

AI-powered customer support that reduces the size of support teams by 80%+

Automated marketing and sales sequences

AI coding assistants that write 40% or more of production code

Product-Market Fit Through Laser Focus

The fastest-growing AI companies solve uncomfortably narrow problems exceptionally well. Abridge, an AI note-taking application, achieved rapid growth by focusing exclusively on saving physicians 300+ hours per year on charting. The ROI is obvious and undeniable, and it led to viral adoption within their target market.

Gorkem Yurtseven is the co-founder of fal, which operates at the forefront of AI Inference, particularly in generative media. Fal’s mission is to empower developers to create the next generation of creativity tools. He explained their breakthrough this way:

“Everyone assumed all AI models were one market. We saw early that buyers for media models were different. That focus changed everything.”

By dominating the “generative media inference” category rather than trying to serve all AI workloads, fal accelerated adoption and established category leadership.

Go-to-Market Efficiency

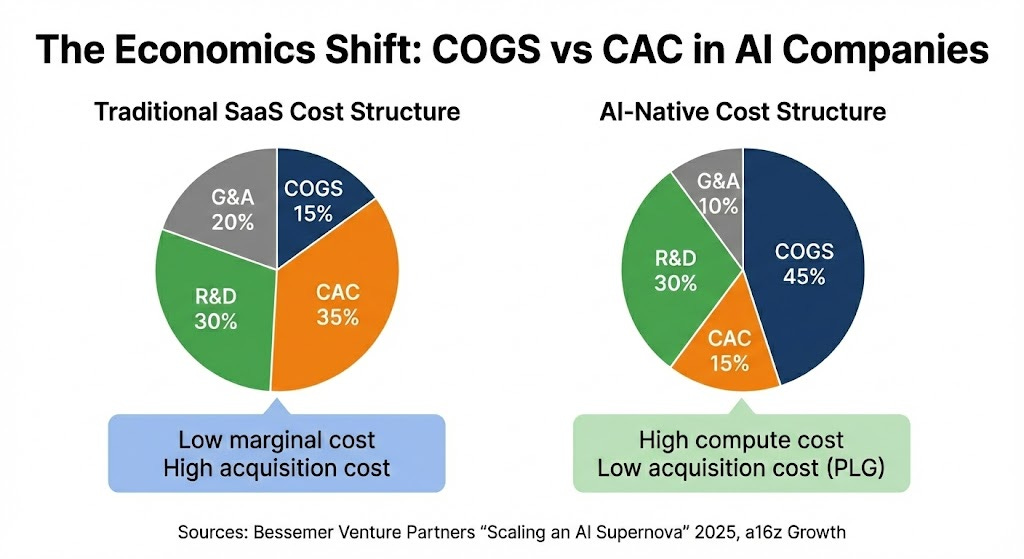

Traditional enterprise sales models aren’t competitive with the economics of an AI-native sales approach. With compute costs consuming 40-50% of revenue (versus 10-15% for traditional SaaS), AI-native companies cannot afford both high COGS and high customer acquisition costs.

The solution? Product-led growth. A16z’s research shows that median AI-native B2B companies now reach $2+ million in ARR in their first year. AI-native B2C companies reach $4.2 million in ARR. That’s 2-4x faster than the average SaaS company five years ago.

AI-native companies achieve this through:

Usage-based pricing that aligns costs with value delivered

Freemium models with generous free tiers convert high-intent users

Community-driven growth (Midjourney’s Discord server has 21+ million members)

Founder-led sales for the first 10-20 customers to validate demand

Zero or minimal marketing spend, relying on product quality and word-of-mouth

Financial Management in the AI Era

VC giant Bessemer has conducted extensive analysis of how AI-native companies operate. One big takeaway:

COGS are the new CAC

Traditional SaaS companies could ignore marginal costs because every new user was nearly pure gross profit. AI companies face much higher infrastructure and delivery costs, which compresses gross margins to 50-60% versus 75%+ for traditional software.

This requires ruthless financial discipline. Companies must optimize inference costs, choose efficient model architectures, and design pricing that captures value while covering compute expenses. The Rule of 40 (growth rate + free cash flow margin) no longer applies cleanly when you’re growing 200%+ annually but running 40% gross margins.

AI-native founders are cracking the financial code:

Y Combinator-backed companies - almost all of which are AI-native companies - are now raising 50% less than the companies in the 2022-2023 cohorts while hitting the same revenue milestones.

The Metrics That Matter

CB Insights’ analysis of top AI-native startups reveals that companies like Mercor ($4.5M revenue per employee) and Cursor ($3.3M per employee) already surpass Microsoft ($1.8M) and Meta ($2.2M), rivaling even Nvidia’s efficiency ($3.6M).

Core Performance Indicators

Speed metrics dominate the AI era:

Time to $10M ARR: 12-18 months (vs 3-5 years for traditional SaaS)

Time to $100M ARR: 21-36 months for leaders

Monthly growth rates: 15-30% sustained through $10M ARR

Retention and expansion validate product-market fit:

Net Revenue Retention: 120-140% for top performers

M12/M3 retention ratio: >100% (revenue at month 12 divided by month 3)

Churn rates: <5% monthly for B2B, <8% for B2C after initial tourist churn

Unit economics reflect AI’s different cost structure:

LTV: CAC ratio: 3:1+ (same as SaaS, but harder to achieve)

CAC payback: 11-16 months (compressed by lower margins)

Gross margin: 50-60% (vs 75%+ for SaaS)

Revenue per employee: $1M-3M+ market for leaders

Operational efficiency separates winners from losers:

Inference cost per token/query trending downward

Percentage of processes automated: 70%+

Engineering leverage: 40-50% of code AI-generated

The Limits and the Future

Deploying an AI-native business model doesn’t guarantee success. You’ve got to put all the right ingredients in place and outperform other AI-native companies and big incumbents to succeed. Here are some of the things that could slow your progress:

Your founding team is only very good, not exceptional.

Your products require deep relationship-building to sell successfully, making your path to $1 million in ARR per employee longer.

Your model depends on the continued improvement of your own and third-party AI tools.

AI-native companies selling to highly regulated industries or those requiring extensive customization still need larger teams.

“Revenue lags users, and users lag product quality. Our top metric is whether we personally want to use it every day.”

Jacob Jackson, Cursor

This obsession with product love over vanity metrics defines the new AI-native era.

The Takeaway

The $1 million in ARR per employee benchmark isn’t just about efficiency; it’s about building fundamentally different companies. As AI capabilities improve and compute costs decline, we may see this benchmark rise to $2M or even $3M per employee for category leaders. The companies mastering this model today are writing the playbook for the next decade of startup creation.

AI Metric of the Week

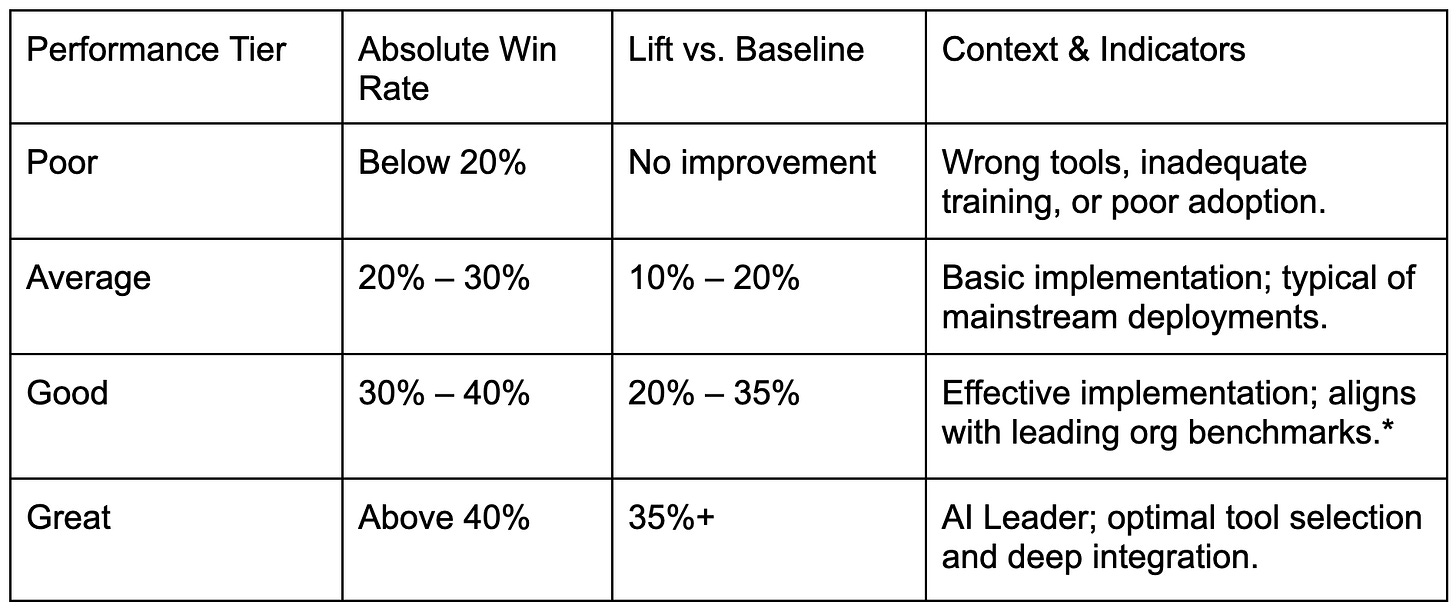

AI-Assisted Win Rate

AI-Assisted Win Rate measures the percentage of sales opportunities that result in closed deals when sales representatives use AI tools for recommendations, research, insights, content generation, and coaching. It quantifies AI’s direct impact on sales effectiveness and deal closure.

How It Is Used

Sales leaders track this metric to evaluate whether AI tools are improving win rates, identify which AI capabilities drive the best results, and compare performance between AI-enabled and non-AI-enabled teams. This metric is also used to justify continued investment in sales AI platforms and guides training priorities for sales executives.

The Formula

AI-Assisted Win Rate = (# of AI-Assisted Deals Won / Total AI-Assisted Opportunities) × 100

AI-Assisted Deals Won: Closed-Won opportunities where reps actively used AI tools during the sales cycle

Total AI-Assisted Opportunities: All qualified opportunities where reps had AI tools available and engaged

Comparison Baseline: Track win rate for non-AI opportunities to measure incremental lift

Segmentation: Break down by deal size, industry, product line, and rep experience level - also important to calculate for core ICP only

Attribution: Document-specific AI tool usage (recommendations accepted, content used, insights applied)

Cohort Based: When calculating Win-Rate, it is critical to use a time-based, cohort approach

Why This Metric Matters

Win rate is the ultimate measure of sales effectiveness. Even modest win-rate improvements generate a substantial revenue impact:

A 5 percentage-point increase in win rate for a team closing $50 million annually creates $2.5M+ in additional revenue.

This metric shows whether AI tools deliver on their promise or merely create busywork for sales teams. Enterprises use win rate data to decide whether to expand AI deployment, which tools to prioritize, and how to optimize AI usage patterns.

Executive Usage by Role

CRO/VP Sales: As the primary owner of the win rate metric, the CRO uses AI impact data to justify technology budgets and set performance targets. The CRO compares AI-enabled vs. traditional teams to guide rollout strategy and resource allocation.

CEO: Reviews win rate trends as an indicator of sales effectiveness and competitive positioning. Uses AI win rate data when reporting progress to the board on technology transformation initiatives.

CFO: Evaluates win rate improvements’ revenue impact to calculate sales AI ROI. Connects win-rate gains to reduced customer-acquisition costs and improved revenue predictability.

Sales Enablement: Analyzes which AI tools and usage patterns correlate with the highest win rates to optimize training programs. Identifies best practices from top performers for broader adoption.

CTO/CIO: Uses win rate data to prioritize platform investments and evaluate vendor solutions. Investigate technical factors (integration quality, user experience) affecting win rate performance.

Performance Benchmarks

Note: Win rates vary significantly by industry, deal complexity, and sales cycle length. Enterprise software often shows baseline win rates of 15-25%, while transactional B2B may exceed 40%. Compare AI impact within the same segments rather than across different sales motions.

Real-World Examples

Monitoring

A SaaS company tracks AI-assisted win rates weekly across 85 account executives using their sales intelligence platform.

Their executive dashboard shows a current win rate of 34% for AI-assisted deals versus 22% for non-AI deals (55% improvement).

They segment by deal size (SMB: 41%, Mid-Market: 32%, Enterprise: 28%) and track which AI features correlate with wins: competitive intel (62% higher win rate when used), AI-generated proposals (48% higher), and next-best-action recommendations (41% higher).

Monthly reports identify top performers and their AI usage patterns.

Problem Correction

A financial services sales team deployed AI conversation intelligence but saw win rates remain flat at 23% after six months.

Analysis revealed reps rarely reviewed call insights or follow-up recommendations.

The sales enablement team implemented weekly AI insight review sessions with managers, added AI usage to performance scorecards, and showcased wins directly attributable to AI recommendations.

Within four months, win rates improved to 31% as AI tool adoption increased from 35% to 78% and reps learned to act on AI insights systematically.

Performance Improvement

An industrial equipment manufacturer improved AI-assisted win rates from 18% to 37% over 18 months through layered AI capabilities.

Initially, their AI CRM provided basic next-step recommendations (18% → 24% win rate).

They added AI-powered competitive intelligence and objection handling (24% → 30%).

Finally, they implemented an AI proposal-generation system tailored to industry verticals (30% → 37%). Each enhancement targeted the next biggest sales bottleneck, with continuous training ensuring adoption exceeded 85%.

Critical Success Factors

Establish clear baseline win rates before AI deployment and segment by deal type, size, complexity and “in vs out” of Ideal Customer Profile (ICP). Without accurate baselines, measuring AI impact is impossible.

Track AI tool usage alongside win rates to understand which capabilities drive results. High win rates mean nothing if reps aren’t using AI tools—correlation doesn’t prove causation.

Segment analysis by rep experience level to identify if AI helps novices more than veterans, or vice versa. Training strategies should differ based on who benefits most.

Compare similar deal types rather than aggregate data. AI’s impact on $10K deals differs from its impact on $1M deals. Segment-based metrics highlight important performance patterns.

Investigate losses, not just wins, to understand when AI fails to help or provides bad recommendations. Learning from failures improves AI effectiveness faster than celebrating successes.

Ensure proper attribution by documenting which AI tools were actually used during won deals. Self-reported usage may be inaccurate; integrate tracking into CRM workflows.

AI Case Study of the Week

McKinsey & Company

Company Overview

McKinsey & Company is a global management consulting firm that advises leading enterprises on strategic, operational, and technological transformations. With a century of experience and over 45,000 professionals, the firm operates as a “knowledge factory,” synthesizing vast amounts of data to solve the world’s most complex business challenges.

The AI Challenge: Breaking the 100-Year Silo

McKinsey’s primary challenge was an internal knowledge paradox:

Despite possessing one of the world’s most valuable archives, including 100,000+ proprietary documents, frameworks, and interview transcripts, this data was trapped in fragmented silos.

Consultants were spending 20-30% of their time manually searching for historical benchmarks and relevant experts.

The specific hurdles included:

Data Security: Public AI tools posed an unacceptable risk to client confidentiality.

The “Hallucination” Risk: Consultative work requires 100% accuracy; generic LLMs could not provide the necessary citations or “grounded” truths.

The Time-to-Insight Gap: The firm needed to bridge the gap between “having information” and “activating insights” at the speed of modern business.

Implementation Plan: The Five-Point Framework

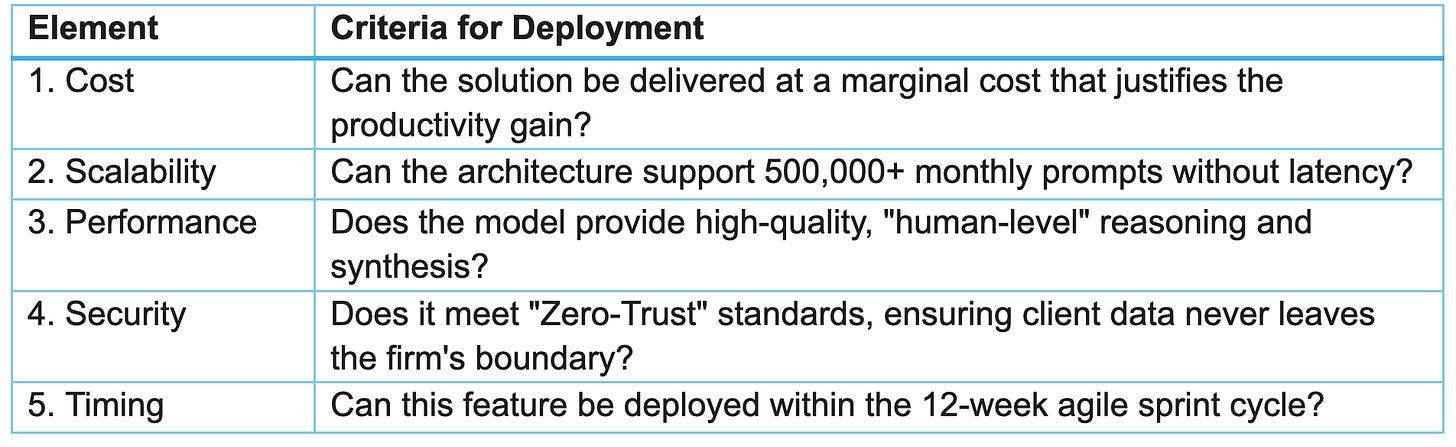

McKinsey’s AI arm, QuantumBlack, developed Lilli, a secure generative AI platform. To move from prototype to firm-wide deployment in just 12 weeks, they utilized a rigorous Five-Point Evaluation Framework for every feature built:

Technology Stack:

Architecture: Built on a Retrieval-Augmented Generation (RAG) pipeline to ground answers in McKinsey-only data.

Vendors: Leverages Microsoft Azure OpenAI Service for core LLM power, with specialized models from Anthropic and Cohere for reasoning tasks.

Governance: Integrated with Credo AI for bias, privacy, and performance monitoring.

Results: Transforming the Workforce from Researchers to Strategists

The incorporation of Lilli has fundamentally “rewired” McKinsey’s operating model, moving it from a labor-intensive research model to an agentic organization.

Operational Efficiency: Over 75% of the firm uses Lilli monthly, saving an average of 30% on research and synthesis time. This recovers roughly 50,000 labor hours per month, valued at approximately $12M in capacity.

Accelerated Deliverables: Features like the “One-Click” agent allow consultants to generate client-ready PowerPoint decks and proposals in hours rather than days.

Strategic Sparring: Lilli now acts as a “thought-partner,” helping consultants identify weaknesses in arguments and anticipate client questions before meetings.

“A small group of us asked, ‘What if we took GPT technology and trained it on our own knowledge, encapsulating 100 years of McKinsey in a digital experience?’ Lilli is not just a tool; it’s a researcher, a time saver, and an inspiration.”

— Erik Roth, Senior Partner and Global Leader of Generative AI, McKinsey

“Lilli has unleashed the creative potential in our people. They are helping clients in ways we never anticipated. We have the muscle now to think about supercharging this capability globally.”

— Phil Hudelson, Partner, McKinsey

McKinsey, AInvest, DigitalDefynd

AI Report of the Week

“The Enterprise in 2030” report by the IBM Institute for Business Value

“The Enterprise in 2030” report defines a roadmap for organizations to transition into “smarter enterprises” that are modular, adaptive, and software-driven.

Key Predictions for 2030

Competitive Pressure and Big Bets

AI competition is now measured quarterly, not over multi-year horizons. Speed matters more than perfection, with 55% of executives prioritizing rapid execution over flawless decision-making.

The Productivity Flywheel

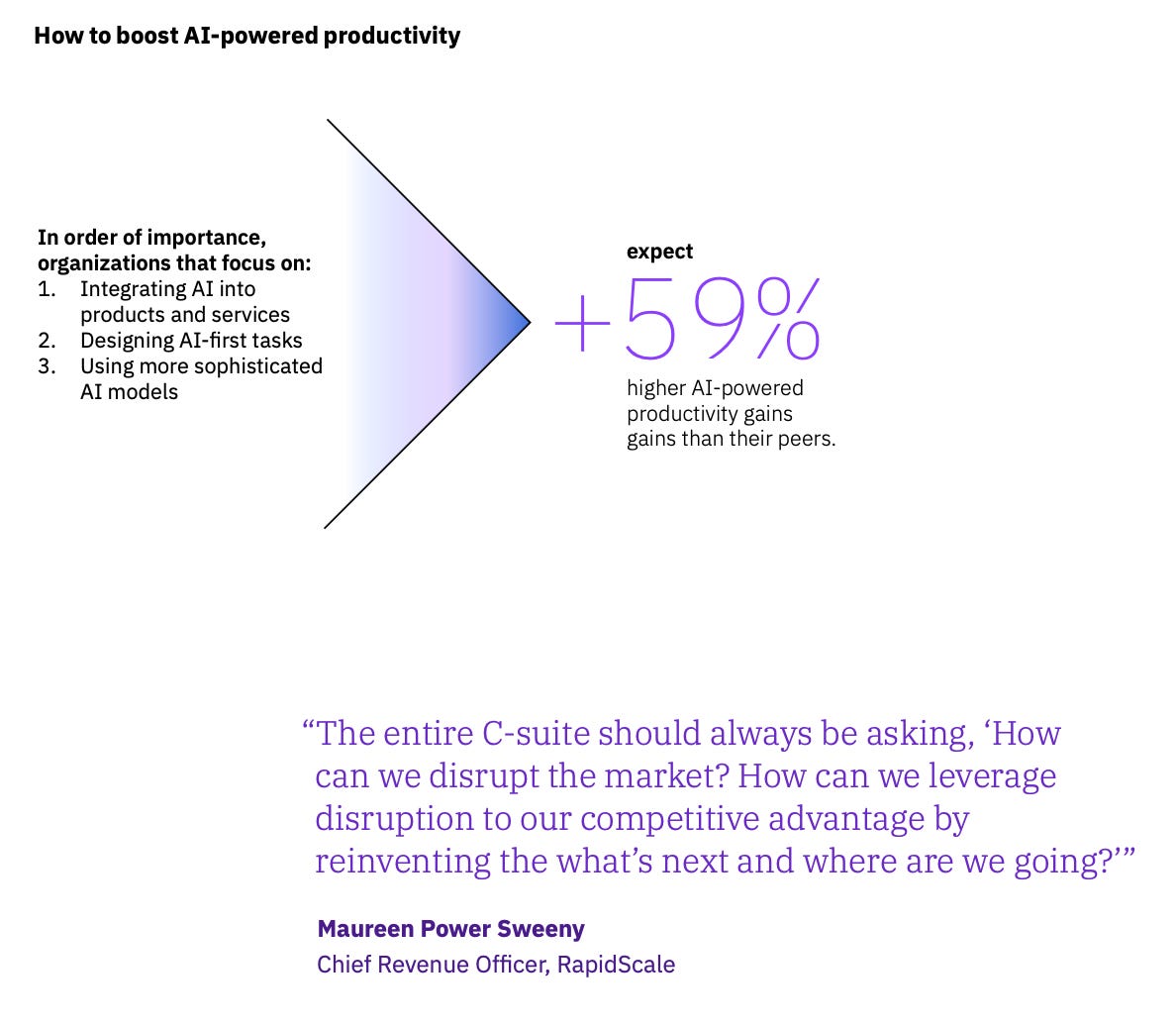

Enterprises expect AI to lift productivity by 42% by 2030. The winners will reinvest those gains into innovation and new business models, creating a compounding growth loop rather than one-time efficiency gains.

Customized and Tailored AI

Competitive advantage is shifting away from massive general models toward proprietary portfolios of Small Language Models and tuned foundation models. By 2030, 72% of executives expect SLMs to play a larger role than LLMs inside their organizations.

The Evolution of Knowledge Work

AI will handle most routine knowledge tasks, from reporting to code generation. Human value will increasingly center on judgment, creativity, critical thinking, and orchestrating AI agents.

The Quantum Shift

Quantum-enabled AI is expected to be transformational, with 59% of executives anticipating major industry disruption. Yet readiness lags, as only 27% expect to be using quantum technology by 2030.

Key Findings

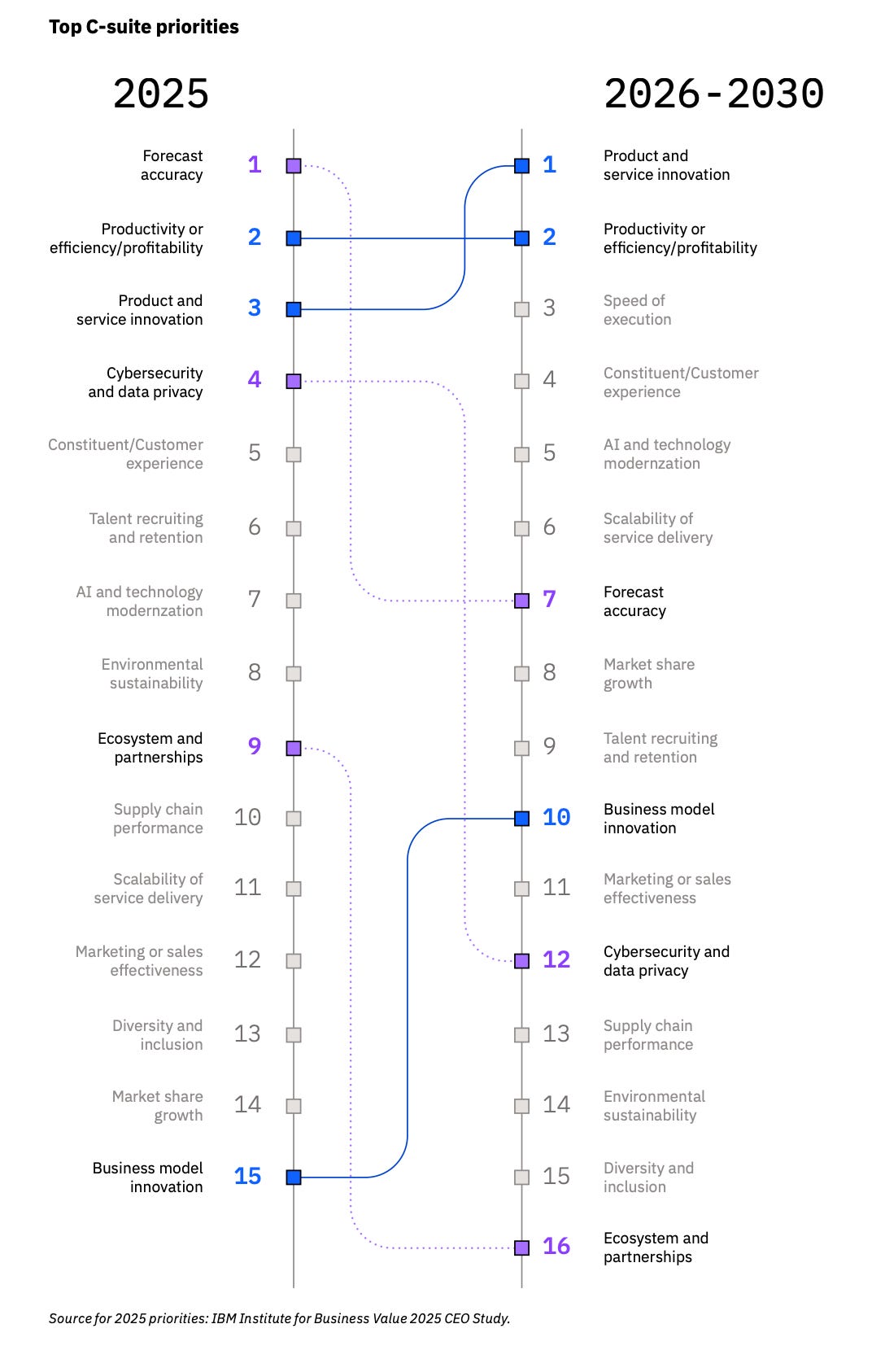

Strategic Priorities

Product and service innovation is now the top priority for 2026–2030, overtaking cost efficiency. Business model innovation and market share expansion are also rising fast.

Financial Performance

Organizations using a multi-model strategy expect 24% higher productivity gains and 55% greater operating margin improvement than those relying solely on large pre-trained models.

Workforce Impact

Skills are depreciating rapidly. 57% of executives believe today’s employee skills will be obsolete by 2030, and 56% of the global workforce will need reskilling by the end of 2026.

Leadership Mindset

Adaptability now outweighs technical depth. 67% of executives say a growth mindset will matter more than specific skills, and 68% expect to have a Chief AI Officer by 2030.

Cybersecurity Evolution

Cybersecurity is becoming an AI-driven, self-healing foundation. Already, 30% of enterprises have built AI-first security systems that can self-regulate and self-correct.

IBM Institute for Business Value

AI to ROI - Just the News Edition

In addition to the AI to ROI Newsletter, we publish the “AI to ROI - Just the News Edition on Saturday mornings. This edition provides a rundown of the top 10 AI news stories of the week, along with links to several dozen AI-related news stories across a wide range of topics, including AI startups, hyperscalers, AI and enterprise adoption, AI and government, and AI-related thought leadership. Be sure to subscribe to get both.

The AI-assisted win rate metric deserves more attention. It moves AI measurement from 'activity' (emails sent, calls analyzed) to actual business outcomes. That's how you prove value, not just usage.

This breakdown of the $1M ARR per employee trend is absolutly killer, especially the insight that COGS are the new CAC for AI companies. What really struck me was how Midjourney's 11-person team proves that distribution through community (Discord) can totaly replace traditional marketing departments. We've been experimenting with AI coding tools at my startup and honestly the 40% code generation stat feels conservative, our senior devs are hitting closer to 60% on greenfield projects. The McKinsey case study showing 50,000 hours recovered monthly really drives home how this isn't just about startups, it's reshaping consulting economics too.